Texas school bond election stakeholders held a panel in Austin last month to address the highest defeat in school bond propositions in Texas history in the November 2021 election. The panel was just one of many conducted at SXSW EDU.

SXSW EDU is a component of the South by Southwest (SXSW) family of conferences and festivals to drive impact in education.

The panel called, The Art & Science Behind Passing a Bond Election (listen to the shocking, newly discovered audio by clicking on this link) gave advice on how to overcome this obstacle by deceiving voters with what panelists saw as one of the biggest challenges to the process.

The challenge was created by the passage of House Bill 3 in 2019 that now requires the disclosure, “This is a property tax increase,” to be included in every school bond proposition. In past bond elections, school districts would commonly tell voters their tax rates would not increase.

Property values increase yearly causing taxes to increase, even without a rate increase. Bond debt is paid back with property taxes. Bond passages unavoidably increase property taxes. When passed, bond propositions also give the district the ability to apply additional taxes needed to repay the debt without voter approval in the future.

According to panelist Chris Huckabee, CEO of Huckabee Inc., whose business is school bond financed construction, this is bad for business. His solution came from a colleague.

“I had a very smart superintendent tell me the other day, I will never do a bond election ever that I don’t have a tax increase, it may be a quarter of a penny, it may be a tenth of a penny, I’m always going to do it, and I’m going to go tell the world it’s a tax increase, it’s a tenth of a penny, it’ll cost you one dollar and I went, that’s brilliant, so rather than us fighting this, hell, lets join them, let’s just start taxing people.”

Panelist Mike Martindale, Superintendent of College Station ISD said “that’s interesting because after we did ours, we were kinda sitting around and reflecting, we were like you know, next time, you’re right, hell, let’s just have a tax increase then, right? Minimal, but let’s just have it so we’re not trying to explain to people.”

Panelist Martha Salazar-Zamora, Superintendent of Tomball ISD suggested a different scheme, she used a list of every staff member that could vote in the bond election which helped her get what she needed in her district to pass its bond in 2021.

Wishing she had thought to add a small tax rate to her bond package, Salazar-Zamora added, “We went out and said, this is not a tax rate increase, despite what it says all in caps, trust me.” She was not able to pass all the bond propositions she wanted.

She went on to say that she would encourage anybody moving forward to be as smart as that superintendent, and make sure to include a tax increase and tout how small it is to justify the new requirement.

School taxes and school bonds can be complicated. Districts use this knowledge to confuse voters and mislead them to promote school bonds. Texas taxpayers need to be aware that district leaders in Texas are actively collaborating to deceive their voter base to increase the pass rate of these school bonds.

The biggest way districts get support is by pulling on the heart strings of their community members hyping the benefits to our children, grandchildren, and their futures. Districts display their awards, distinctions, and shinning accolades during these elections, but what do these accolades really say about how well our children are being educated, which should be the priority in every school district.

In August 2019, Dallas Morning News reported that “Texas is dead last when it comes to passing standards for measuring how well children are reading by the fourth grade, according to a federal analysis of states’ standardized tests.”

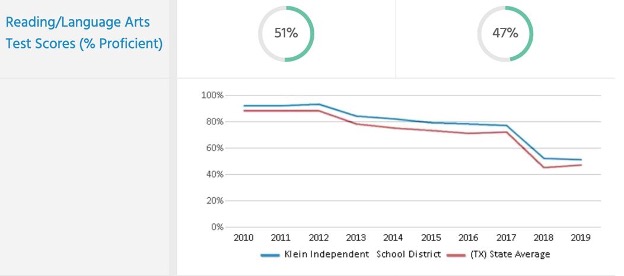

At the local level, Klein ISD touts winning District of the Year in 2021, but the students who met grade level in writing were at 36%; 42% in math and 50% in reading. Like many districts these numbers were lower than those pre-pandemics. Before the pandemic, performance was still not ideal. Klein ISDs academic performance from 2010 through 2019, test scores show the percentage of students proficient in reading and language arts dropped from 51% to 47%.

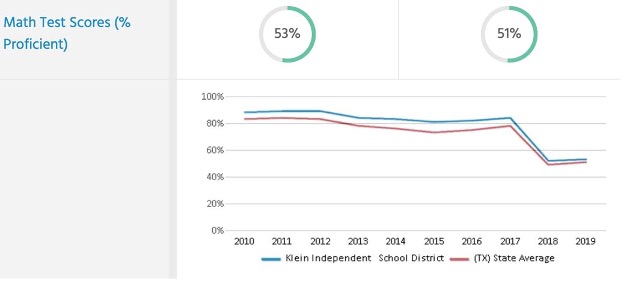

Testing scores show the percentage of students proficient in math, dropped from 53% to 51% pre-pandemic.

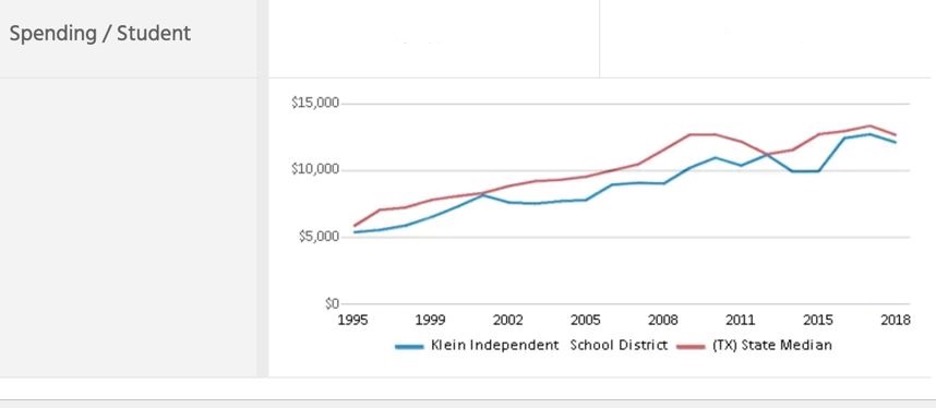

Meanwhile, the amount spent per student is steadily increasing, as educational outcomes are decreasing.

Meanwhile, the amount spent per student is steadily increasing, as educational outcomes are decreasing.

Klein ISDs estimated outstanding debt obligations according to Kleins Voter Information Document is currently at $1,509,995,117. The Total outstanding debt (principal only) is $20,288 per student according to Klein ISDs most recent annual budget report.

Klein ISDs estimated outstanding debt obligations according to Kleins Voter Information Document is currently at $1,509,995,117. The Total outstanding debt (principal only) is $20,288 per student according to Klein ISDs most recent annual budget report.

Texas school districts should focus on educating our children rather than how to manipulate the new legal disclosure requirement just to pass more school bond propositions. As each year passes, Texas districts spend more per student, while students are performing worse. There is no correlation between increased spending per student and better educational outcomes. Texas school district leaders need to take a hard look at why this downward trend is occurring before asking the community to vote for another bond.

Senator Pat Fallon issued this statement on school districts pushing to pass school bonds.

“Our taxpayers and parents are entitled to have their schools focus on our children’s education, not pushing for school bonds. The tax money we give our schools is supposed to be spent on the task at hand—educating our children. All their efforts should be spent shaping the future of our next generation, not pushing political candidates or bond issues.

The vast majority of our teachers and ISD employees do a great job of preparing our children for their future. We honor them and know that most would never use school resources for electioneering. But we have some administrators who just can’t resist the temptation to use public equipment or work time to push for their cause. That isn’t right, and it can’t be allowed to continue.”